Providing secure, guaranteed income strategies for your retirement and business transitions. Fortify your financial future with Castle Annuity.

Schedule a ConsultationIf you are selling a business, real estate, or high-value asset, you may be facing a significant capital gains tax bill. A Structured Installment Sale is a powerful financial tool that allows you to defer those taxes and convert your equity into a guaranteed stream of future payments.

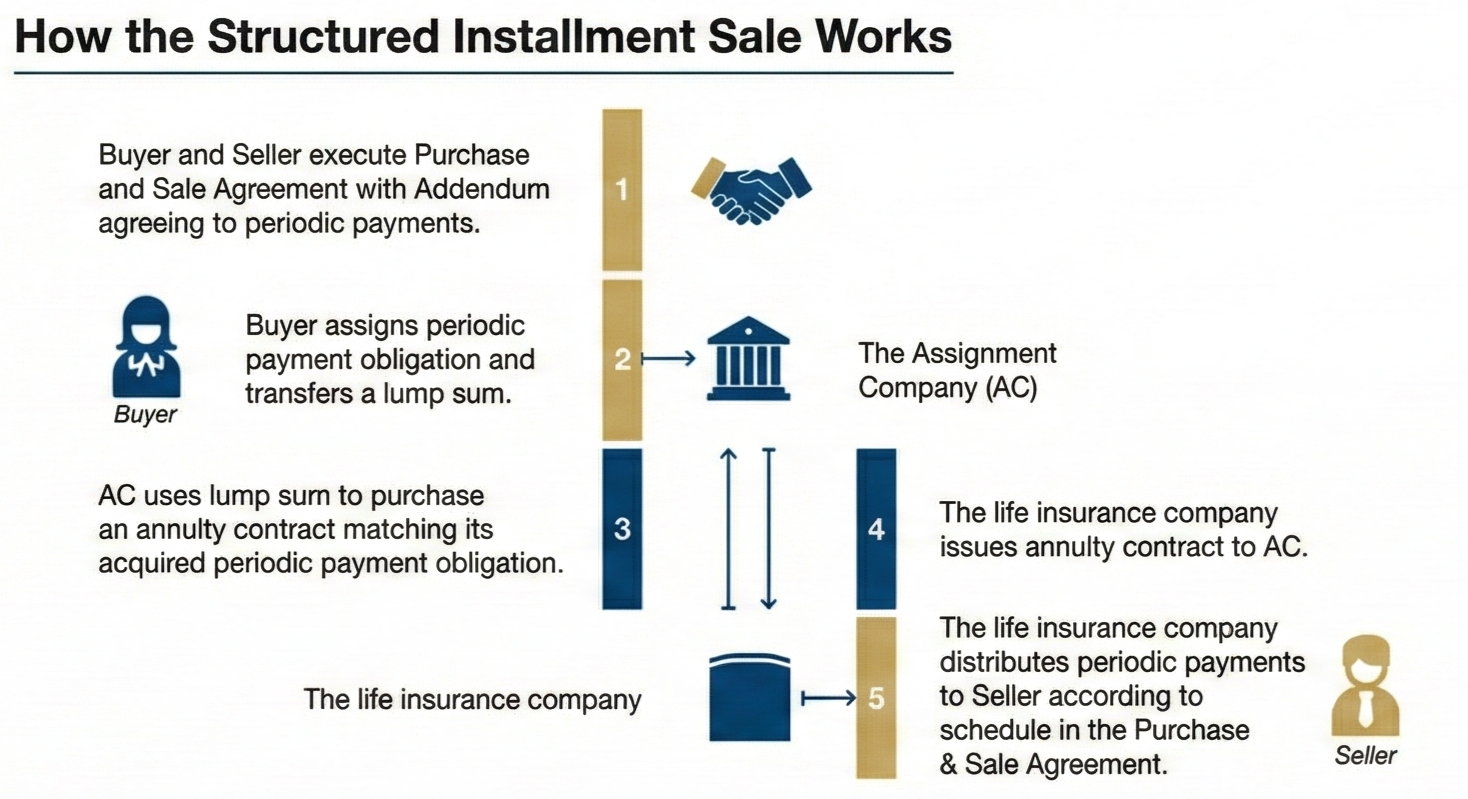

Instead of receiving a lump sum at closing (which triggers immediate taxation on the full gain), you agree to receive payments over time. This is facilitated through an assignment process where the buyer's obligation to pay is transferred to a highly-rated third-party assignment company, which funds the obligation by purchasing an annuity tailored to your needs.

While an SIS is a powerful tool, it is specifically designed for high-value transactions where tax efficiency is a priority. It is an ideal strategy for:

In a traditional installment sale (seller-financed note), you are dependent on the buyer’s ongoing financial health to receive your payments. If the buyer defaults, you may be forced to foreclose or litigate.

The Castle Annuity SIS Advantage:

With our Structured Installment Sale, the buyer assigns their payment obligation to a third-party assignment company. This company purchases an annuity from a highly-rated life insurance company to fund your payments. Once this is established:

Many real estate investors utilize 1031 Exchanges to defer taxes, but that requires you to roll your money into a new property within a strict 180-day window. An SIS offers an alternative for those who are ready to "cash out" rather than buy more property.

| Feature | 1031 Exchange | Structured Installment Sale |

|---|---|---|

| Goal | Swap for new property | Create guaranteed income |

| Liquidity | Money tied up in real estate | Liquid payments over time |

| Management | Active property management required | Zero management (passive) |

We specialize in safe money strategies designed to provide principal protection and guaranteed income.

Secure a guaranteed interest rate for a specific period of time. Fixed annuities offer principal protection and predictable growth, similar to a CD but with tax-deferred advantages.

Includes Immediate & Deferred Solutions:

This category encompasses Immediate Annuities, which convert a lump sum into a guaranteed income stream starting right away, and Deferred Income Annuities, which allow you to create a future income stream that grows until you are ready to receive it.

Participate in the upside potential of market indices (like the S&P 500) while eliminating downside risk. Your principal is protected from market crashes, ensuring your nest egg remains safe.

William Ramsdale brings a wealth of experience to Castle Annuity, while having a degree in Accounting, he spent three decades in the IT industry as a dedicated DevOps professional. His career was defined by an analytical mind, attention to detail, and a commitment to building secure, reliable systems. Now, William leverages this unique skillset in the financial sector, applying his structured problem-solving abilities to help clients build and secure their financial futures through annuity solutions.